In the vast realm of online payment providers, one name stands out prominently – Skrill. With nearly two decades of experience under its belt, Skrill has earned the trust and admiration of millions of users worldwide. In this in-depth exploration, join the CBM team as we navigate through every facet of Skrill, providing you with a complete A to Z guide. We will unravel how this payment system operates, pinpoint the finest Skrill casinos, and even show you where you can use Skrill for free in online casinos. Additionally, we will delve into the intricate world of Skrill fees, transaction timeframes, limits, and other vital aspects of utilizing this payment system in reputable online casinos.

Skrill: A Trusted E-Wallet for Nearly Two Decades

Established in 2001 by Daniel Klein and Benjamin Kullmann, Skrill has solidified its reputation as a trusted e-wallet service provider. For individuals in Germany and across the globe who prioritize security and privacy, Skrill is often the preferred choice, offering a convenient and efficient method for swift deposits and withdrawals. In this comprehensive guide, we’ll take you on a deep dive into everything you need to know about Skrill, the illustrious payment provider.

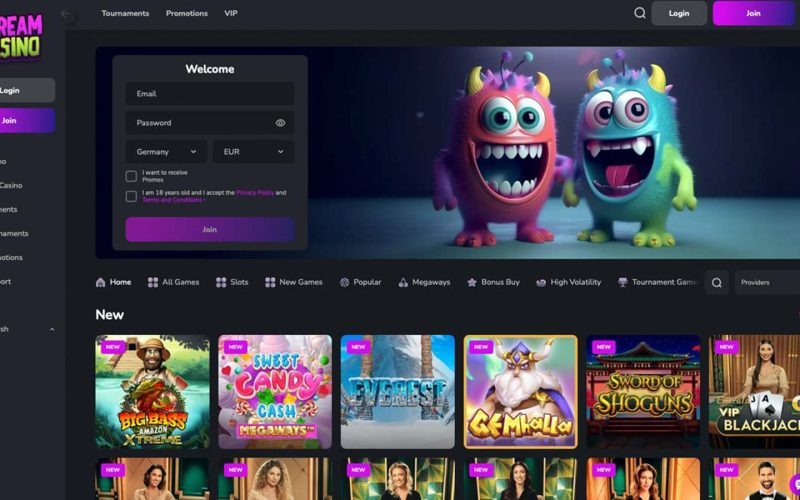

Top Online Casinos Accepting Skrill Payments

Understanding how Skrill operates is crucial, but it’s equally important to have a selection of online casinos that accept Skrill deposits in mind. Fear not; we’ve got you covered! Below, you’ll find a meticulously curated list of Skrill casinos, handpicked by experts specializing in online casino payment methods. These casinos have undergone rigorous checks and assessments to earn the coveted CBM seal of approval. So, without further ado, enjoy!

Company History: Skrill’s Journey to Prominence

Skrill, originally known as Moneybookers, embarked on its journey in 2001, establishing itself as a trailblazer in the world of digital payments. The company swiftly registered with the UK Financial Conduct Authority and became a proud member of the FTSE 250. With its European e-money license in hand, Skrill joined the ranks of pioneers like PayPal in enabling online payments. Remarkably, within just 1.5 years of its inception, nearly 2 million new users had registered to enjoy its numerous benefits.

Skrill’s headquarters are situated in London, with a notable presence in the United States. The year 2011 marked a significant turning point when Moneybookers rebranded itself as Skrill. In the following years, it was acquired by the Paysafe Group for a substantial €1.2 billion, another accomplished British firm that also added Neteller to its portfolio. In 2017, the Blackstone Group LP and CVC Capital Partners reached an agreement to acquire Paysafe Group PLC, the online payment processor, for a staggering £2.96 billion. In 2021, Skrill further enhanced its cryptocurrency services, enabling users to send Ethereum via Skrill, withdraw fiat balances to a crypto address, and engage in trading involving 37 cryptocurrencies on the platform.

Skrill Limited has earned its registration with Her Majesty’s Revenue and Customs as a financial services company. Its international subsidiaries operate under the regulatory supervision of the respective authorities in their operational countries, with FinCEN in the USA being one such example.

Skrill News: Keeping You Updated

Skrill doesn’t rest on its laurels; it keeps evolving and expanding its services. Here are some noteworthy developments:

May 2022: Skrill USA and PlayUp USA launch an exclusive VIP program catering to high-value customers.

April 2022: The company announces an exciting partnership with Apple Pay, enabling users to seamlessly add their Skrill Prepaid Mastercard to their Apple Pay wallets.

November 2021: Skrill adds four new digital currencies to its roster, including IOTX, AVAX, ICP, and AXS, thereby offering users access to more than 40 cryptocurrencies.

October 2021: Paysafe unveils iGaming enhancements for Skrill US, simplifying the process for players to place bets at licensed online gambling providers.

August 2021: The Paysafe Group appoints Chirag Patel, a former head of payments at Amazon and Santander Bank, as the Chief Executive of its Digital Wallets division, further solidifying its position in the industry.

July 2021: Skrill broadens its cryptocurrency offerings by adding 20 more cryptocurrencies to its digital e-wallet, now offering a grand total of 35 cryptocurrencies.

May 2021: The Community Federal Savings Bank in New York issues the Skrill Virtual Visa Prepaid Card, providing users with an added layer of convenience.

April 2021: Paulo Dybala, the Argentine national team player and Juventus icon, becomes a brand ambassador for Skrill, reflecting the company’s growing global influence.

March 2021: Skrill secures an official partnership with Leeds United, a Premier League club, demonstrating its commitment to the world of sports.

March 2021: Skrill extends its cryptocurrency offerings in the USA by partnering with Coinbase, thereby accepting users from several states.

Target Audience: Who Can Benefit from Skrill?

According to their own data, Skrill boasts over 40 million users worldwide, with recent statistics indicating at least 32 million active users. This payment platform extends its support to over 200 countries, including Germany, and facilitates transactions in more than 40 currencies. Instead of pondering which countries Skrill caters to, it might be more fitting to wonder which countries it does not. Indeed, Skrill enjoys global acceptance. However, certain countries, particularly those under the purview of World Bank or UN sanctions, are exceptions. Notable examples of such countries include Afghanistan, Iran, Iraq, Libya, Mali, and Zimbabwe, which find themselves on Skrill’s restricted list.

Skrill’s versatile services cater to various groups

- Online Gamblers: With numerous German and international online casinos accepting Skrill, it is a preferred choice for gamblers seeking to fund their accounts efficiently.

- E-commerce Shoppers: Online shoppers can confidently use Skrill for secure and swift payments, spanning a wide range of goods and services.

- Cryptocurrency Enthusiasts: Skrill’s expansion into the cryptocurrency realm makes it an attractive option for those interested in trading digital currencies.

- Freelancers and Online Workers: Skrill serves as a reliable means of paying freelancers and remote workers across the globe.

Skrill Registration and Verification: A Seamless Process

The registration process for a Skrill

- Visit the Skrill Website: Start by navigating to Skrill’s official website.

- Click “Register”: Locate and click the “Register” or “Sign Up” button on the homepage.

- Fill in Your Details: Follow the prompts to enter your personal information, including your name, email address, and password. Accuracy is key.

- Select Currency: Choose your preferred currency for your Skrill wallet.

- Complete CAPTCHA: Prove your humanity by completing the CAPTCHA.

- Agree to Terms: Take a moment to read and agree to Skrill’s terms and conditions.

Verify Your Email: Skrill will send you a verification email. Simply click the provided link to verify your email address.

The verification process

- Identity Verification: You may be required to furnish a copy of your government-issued ID, passport, or driver’s license.

- Address Verification: Submit a document, such as a utility bill or bank statement, to corroborate your address.

- Source of Funds: Skrill might seek information regarding the source of the funds you intend to use with your account.

It’s essential to note that verification requirements may vary depending on your location and the nature of the transactions you plan to execute.

Depositing Funds to Skrill: Convenience at Your Fingertips

Once your Skrill account is up and running, you can begin adding funds to it with ease. Skrill provides a variety of deposit methods, including:

- Bank Transfer: Transferring funds from your bank account to your Skrill wallet via bank transfer is a commonly used method.

- Credit/Debit Cards: Skrill readily accepts major credit and debit cards, including Visa and Mastercard, for deposits.

- Alternative Payment Methods: Depending on your location, you may have access to alternative payment methods like Paysafecard or NETELLER.

- Cryptocurrency: Skrill has embraced the world of cryptocurrencies, allowing users to deposit funds using digital currencies such as Bitcoin.

It’s important to be aware that certain deposit methods may entail fees, and the availability of deposit options can vary depending on your country of residence.

Withdrawing Funds from Skrill: Simplicity in Action

Withdrawing funds from your Skrill account mirrors the deposit process in terms of simplicity. Here’s a step-by-step guide:

- Log In: Begin by signing in to your Skrill account.

- Navigate to Withdraw: Locate the “Withdraw” section within your account.

- Select Withdrawal Method: Choose your preferred withdrawal method, which may include bank transfers, credit/debit cards, or another option available in your region.

- Enter Withdrawal Details: Provide the withdrawal amount and any pertinent information, such as bank account details.

- Confirm Withdrawal: Take a moment to review the provided details and confirm the withdrawal.

- Wait for Processing: Skrill will initiate the processing of your withdrawal request. The time required to receive your funds hinges on the chosen withdrawal method.

Skrill Fees: Navigating the Cost Landscape

Skrill imposes fees for various types of transactions, encompassing deposits, withdrawals, and currency conversion. Staying informed about these fees is pivotal for effective management of your Skrill account. Here are some key fees to keep in mind:

- Deposit Fees: Skrill generally does not charge fees for adding funds to your account via bank transfer. However, fees may be applicable to other deposit methods, such as credit/debit cards.

- Withdrawal Fees: The withdrawal fees you encounter will depend on the withdrawal method chosen. Bank transfers often come with a fixed fee, whereas credit/debit card withdrawals might involve a higher percentage-based fee.

- Currency Conversion: When engaging in transactions using a currency different from your Skrill account’s base currency, Skrill applies a currency conversion fee, typically hovering around 3.99%.

- Inactivity Fee: If your Skrill account experiences inactivity, defined as no logins or transactions for a period exceeding 12 months, Skrill may levy an inactivity fee.

- VIP Benefits: Skrill offers a VIP program tailored for high-volume users, entailing reduced fees and additional perks.

It is advisable to consult Skrill’s official website for the most up-to-date fee information, as fee structures may undergo changes over time.

Using Skrill in Online Casinos: A Winning Proposition

Skrill is a favored choice among online casino enthusiasts, with many reputable casinos in Germany and beyond readily accepting Skrill for both deposits and withdrawals. Here’s a breakdown of how to use Skrill for online casino transactions:

- Select a Skrill Casino: Begin by choosing an online casino that supports Skrill as a payment method. Ensure the casino is licensed and trustworthy.

- Register and Log In: Sign up for an account at your chosen casino and log in.

- Visit the Banking/Cashier Section: Navigate to the casino’s banking or cashier section, where you can initiate deposits and withdrawals.

- Choose Skrill as the Payment Method: Select Skrill from the list of available payment options.

- Enter Deposit Amount: Input the amount you wish to deposit into your casino account.

- Complete the Transaction: Follow the prompts to finalize the Skrill transaction. You may be redirected to the Skrill website to log in and authenticate the payment.

- Start Playing: Once your deposit is processed, you can commence playing your preferred casino games.

Withdrawing your casino winnings to Skrill is a similar procedure, involving the selection of Skrill as your withdrawal method and the provision of the requisite details.

Benefits of Using Skrill in Online Casinos:

Leveraging Skrill for online casino transactions offers a slew of advantages:

- Security: Skrill incorporates robust security measures, including two-factor authentication, to safeguard your financial data.

- Speed: Deposits and withdrawals executed through Skrill are typically processed swiftly, affording you prompt access to your funds.

- Anonymity: Skrill transactions offer a level of privacy, as your financial particulars are shielded from the casino.

- Widespread Acceptance: Skrill is accepted at a multitude of online casinos, rendering it a convenient choice for players.

- VIP Program: Skrill boasts a VIP program that rewards high-volume users with reduced fees and additional benefits.

It is essential to be cognizant of any associated fees when employing Skrill at online casinos, as both the casino and Skrill may have distinct fee structures.

Skrill Alternatives: Exploring Your Options

While Skrill is undeniably popular in the realm of online payments, it is prudent to consider several alternatives, contingent on your specific needs:

- PayPal: Widely embraced for online transactions, PayPal offers a user-friendly interface and extensive acceptance.

- NETELLER: Also part of the Paysafe Group, NETELLER provides similar services to Skrill.

- Payoneer: Known for its global payment solutions, Payoneer is a top choice for freelancers and businesses.

- Revolut: Offering a comprehensive array of financial services, including currency exchange and international transfers, Revolut is a versatile option.

- Crypto Wallets: If you harbor an interest in cryptocurrencies, cryptocurrency wallets may be a viable alternative for online transactions.

Prior to selecting an alternative to Skrill, it is advisable to conduct a comparative assessment of fees, supported countries, and the specific features that align with your preferences.

In Conclusion: The Versatility of Skrill

In summation, Skrill represents a versatile online payment platform with applications spanning online gambling, e-commerce, and freelancing. To embark on your journey with Skrill, initiate the registration process, complete the verification requirements, and select from an array of deposit methods. Stay informed about Skrill’s fees, and take advantage of its strengths, including security and rapid transaction processing, when utilizing it for online payments. Finally, explore alternative payment options to discover the one that aligns most harmoniously with your individual requirements.

FAQs (Frequently Asked Questions)

What is Skrill, and what are its main uses?

Skrill is an online payment platform that serves various purposes, including online gambling, e-commerce, cryptocurrency trading, and payments to freelancers and remote workers.

How do I register for a Skrill account?

To register for a Skrill account, visit Skrill’s official website, click “Register,” and follow the steps provided, which include providing personal information and verifying your email.

What is the verification process for a Skrill account?

Skrill’s verification process typically involves verifying your identity, confirming your address, and providing information about the source of funds you plan to use with your account.

What are the options for depositing funds into a Skrill account?

Skrill offers various deposit methods, including bank transfers, credit/debit cards, alternative payment methods, and even cryptocurrency deposits.

How do I withdraw funds from my Skrill account?

To withdraw funds from Skrill, log in to your account, navigate to the withdrawal section, select your preferred withdrawal method, enter the necessary details, confirm the withdrawal, and wait for processing.

Are there fees associated with using Skrill?

Yes, Skrill charges fees for various types of transactions, including deposits, withdrawals, and currency conversion. Fees can vary depending on the transaction type and location.

Can I use Skrill for online casino transactions?

Yes, Skrill is commonly accepted at many online casinos. You can use it to make deposits and withdrawals for playing casino games.

What are the benefits of using Skrill in online casinos?

Some advantages of using Skrill for online casino transactions include enhanced security, fast processing times, privacy, and widespread acceptance.

Are there alternatives to Skrill for online payments?

Yes, there are alternatives such as PayPal, NETELLER, Payoneer, Revolut, and cryptocurrency wallets. The choice of alternative depends on your specific needs and preferences.

How can I become a Skrill VIP user?

Skrill offers a VIP program for high-volume users. To become a VIP, you need to meet certain criteria, such as reaching a minimum transaction volume. VIP members enjoy benefits like lower fees and dedicated support.