Investments in the gaming sector are not about gambling, but on the contrary, a tangible and lucrative megatrend that may still have the best times ahead. By Christof von Wenzl

Dhe paradigm shift is here. Gone are the days when video gamers were given the stigma of being childish prodigies. Gaming as a pastime is now socially accepted, which is why more and more people are daring to reach for the gamepad and keyboard. According to statistics, more than 3.2 billion people will be regularly active gamers in 2021, while just over two billion people were still regularly playing games in 2016

For an additional boost provided the lockdowns last year, when millions of people were looking for new pastimes for lack of alternatives and then stuck in many cases with video games.

Pandemic winner

Thus, the gaming sector was also one of the clear Corona winners of 2020. The sales and profits of the leading companies from the sector received an additional boost as a result, and share prices benefited disproportionately. As always on the stock market, the party was followed by a hangover. The glory was over at the beginning of the year. The lockdown-related sales increases of 2020 could not easily be repeated in 2021. In addition, there were numerous postponements of new game blockbusters, whereupon analysts and investors turned their backs on many gaming stocks in a huff

Stock market expertise for over 30 years

Weekly more topics, strategies, tips and recommendations from the pros. Subscribe to BÖRSE ONLINE now!

Especially the Western gaming giant made famous by the “Call of Duty” series as well as “World of Warcraft”. Activision Blizzard is currently facing a particularly rough wind from the market. Just a few days ago, the title was sold off by almost 15 percent in view of the postponed hopefuls “Overwatch 2” and “Diablo 4”. The share is already in a downward spiral due to the sexism scandal and the weakness of the former flagship “World of Warcraft;

That one should leave the church in the village at Activision Blizzard, however, is shown by the extremely stable figures. The “Call of Duty” series is and remains a cash cow with over 119 million active players; the latest title “Vanguard” was also released last Friday. In addition, since the takeover of the mobile games publisher King, the company also enjoys an excellent position in the extremely important mobile gaming sector. This is because games for smartphones and tablets account for around half of the $175 billion global gaming market in terms of sales. Despite the expiry of the lockdown effects, the Group expects sales and profits to continue to rise this year;

Although suboptimal from a chart perspective, the recent sell-off provides a good entry opportunity. The balance sheet is stable. Activision Blizzard is even nicely debt-free and with a 2022 P/E ratio of 17.4 ein anti-cyclical tidbit, especially as the Group was recently mostly valued at a P/E ratio of between 25 and 30.

Interesting, but not without risk

The undervaluation becomes even clearer with Tencent, the Chinese tech giant. The billion-dollar profits generated by the Middle Kingdom company with the Wechat app, as well as many other digital services over the years, have been plowed into countless acquisitions and investments, including Tesla, Snapchat as well as the Chinese retail groups Meituan and Vipshop.

The gaming portfolio is particularly strong here. With shareholdings in Activision Blizzard, Ubisoft, Epic Games (Fortnite) and the full ownership of Riot Games (League of Legends), the Chinese are something of the Berkshire Hathaway of the gaming industry. Due to regulatory restrictions in China (for example, minors are now only allowed to spend three hours a week playing online games, and sales with in-game purchases are also severely restricted) and uncertainties related to the Chinese real estate bubble, the stock is cheaper than it has been since 2013. When all holdings are included, the undervaluation widens even more glaringly. However, since Tencent, like some other companies, is being squeezed by the Chinese government, we are cautious and keep the stock at “watch”;

In view of the price halving since 2018 also Ubisoft is now interesting again in terms of valuation. However, the French company also has the lowest margins of the companies under review. With the upcoming 2022 release of a game in the setting of James Cameron’s 2009 movie blockbuster “Avatar” and the recently released and well started latest part of the successful “Far Cry” series, the turnaround could be successful

The circle of shareholders also still includes the founding family around Yves Guillemot, who leads the group together with some family members. The bulging pipeline of game developments provides the share with catch-up potential – for this reason, we are upgrading the value to “buy” again;

Thus, in addition to “Avatar – Frontiers of Pandora” is among other things simultaneously working on a new game in the Star Wars universe, “Rainbow Six Extraction”, as well as “Skull & Bones”, a game in the setting of the buccaneer era of the 18th century

So much creative brainpower must the sports game champion Electronic Arts (EA), which offers hardly any innovations in the form of new versions of the classic soccer game FIFA and other sports franchises every year, but keeps raising the prices. This regularly causes displeasure among gamers, who, due to a lack of alternatives, still reach for FIFA & Co. again and again. For EA, however, this results in net margins of between 25 and 30 percent;

In-game purchases are an additional way for gamers to earn money – for example, they can buy better equipment, utensils or just fancy accessories. What may seem bizarre to outsiders means billions in sales for the gaming corporations. At EA, these also expand the revenue spectrum for the other flagship “Battlefield”, whose latest spin-off “Battlefield 2042” will be on sale from November 19 and is expected to generate high revenues

While Electronic Arts squeezes its customers like lemons in the view of many gamers, the U.S. game developer enjoys Take Two meanwhile, has an excellent reputation in the gaming community. The New York-based company stands for high-quality games with depth and well-told stories that keep players glued to their screens for countless hours

It is not for nothing that the fifth part of the flagship “GTA” has sold over 150 million copies, making it the second best-selling game of all time. For this, the stock also has the highest rating of all the Western gaming forges described. The release of a graphically revised “GTA” trilogy with older parts in November and “GTA 5” in spring 2022 will provide further impetus. So far, the group has only shown weakness in the area of mobile gaming.

With a ten percent share of sales in the third quarter and year-on-year growth of 68 percent, the company is proving that it also intends to gain a foothold in this enormously important segment

A billion-dollar industry

According to the research house Mordor Intelligence, the gaming sector is expected to grow from $175 billion in 2020 to $314 billion in 2026. That represents a percentage annual increase of almost ten percent. And the announcements of Microsoft and Facebook with regard to the virtual parallel universe Metaverse (our industry report from last week), from which gaming companies in particular should benefit enormously with their digital game worlds, is not even included in this calculation. The long-term picture is therefore correct

Those who find individual stocks too risky and therefore prefer to spread their investments over several stocks from the sector could use the VanEck Vectors Video Gaming and eSports ETF set your sights on – our current fund of the week, which is examined in more detail on page 22.

At a glance

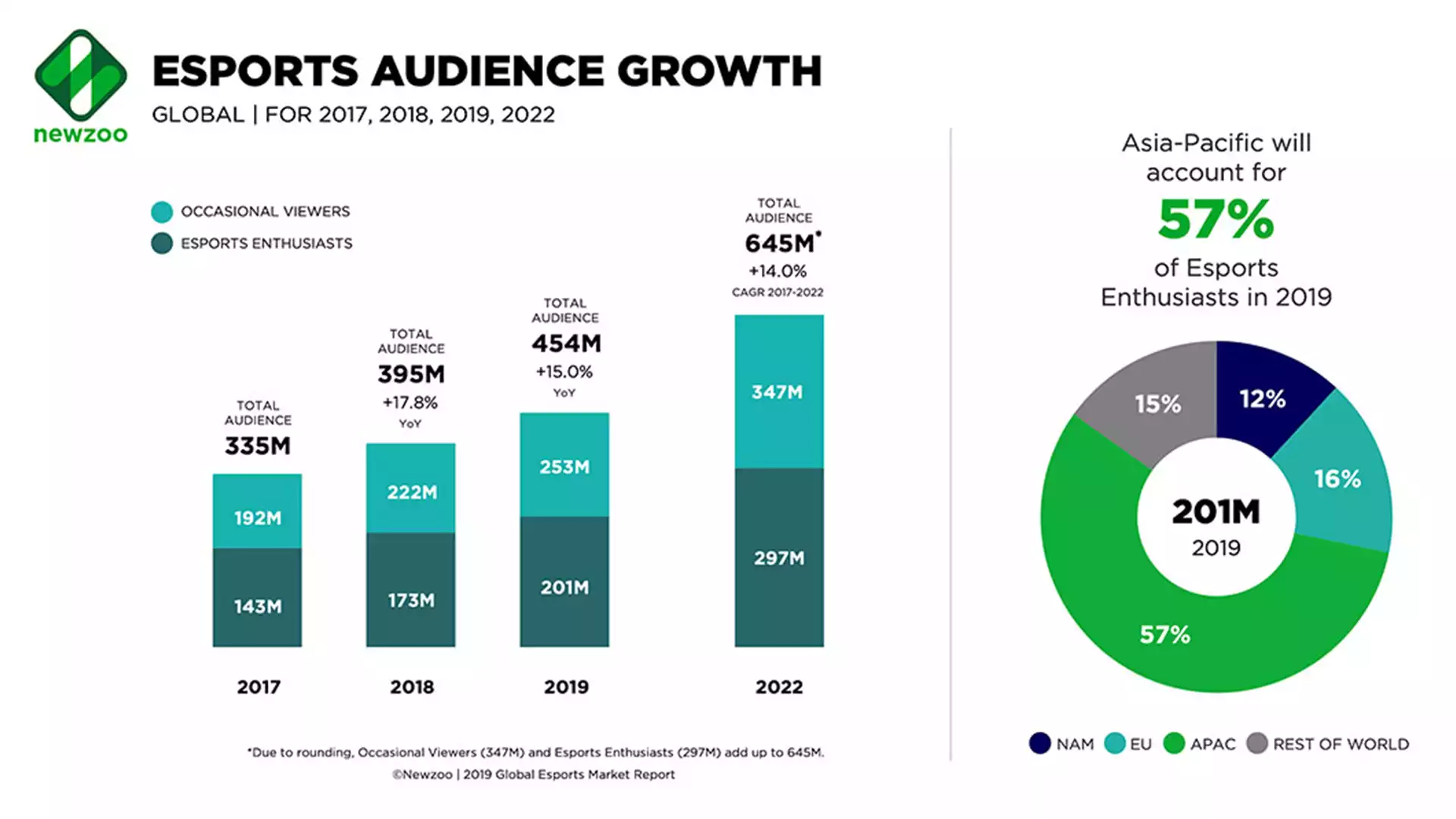

Computer and video games are hip, and the pandemic gave the whole thing another boost. But the sector has been recording steady growth for years. In e-sports tournaments, millions flow to the winners

Image source: BÖRSE ONLINE, BÖRSE ONLINE, BÖRSE ONLINE

Follow us and check out our social media accounts on Twitter, Facebook & YouTube ►

● on Twitter ► esport.directory ● Facebook ► esport.directory ● Youtube ► esport.directory RainbowSixtips, RainbowSixtricks, RainbowSixcheats, RainbowSixhacks, RainbowSixhacks2022, RainbowSixtipspro, RainbowSixpaidcheats, RainbowSix, RainbowSixtipsandtricks, RainbowSixtipsandtricks2022, RainbowSixtipsandtricksforbeginners, RainbowSixtips, RainbowSixtricks, RainbowSixtrickshots, RainbowSixhacks, RainbowSixhacksfree, RainbowSixhacksfree2022,